Persons who are injured in auto accidents have the right to select their own doctors — insurance company’s cannot dictate “preferred providers.” The Michigan Supreme Court made this “right to choose” clear in Morgan v Citizens Ins Co, 432 Mich 640 (1989), when it said that Michigan’s no-fault law “preserves to the injured person a choice of medical service providers.”

The right to choose medical providers is also derived from language that is not in the No-Fault Act (MCL 500.3101, et seq.). Section 3107(1)(a) of the Act does not mention that injured persons are obligated to treat with any particular medical provider. Rather, injured persons can be treated by any medical provider, as long as that provider can lawfully render the services pursuant to §3157 of the Act.

However, some no-fault insurance companies appear to be infringing on this freedom of choice. Or at the very least, they are trying to persuade injured persons to select doctors who are part of the no-fault insurance company’s Preferred Provider Network (PPN). A PPN is a group of medical providers who accept certain discounts for their services.

What’s the concern with PPNs? The fact that the medical providers on these “preferred” lists are not necessarily looking out for the best interests of the injured person. Instead, they typically have the insurance company’s financial interests in mind.

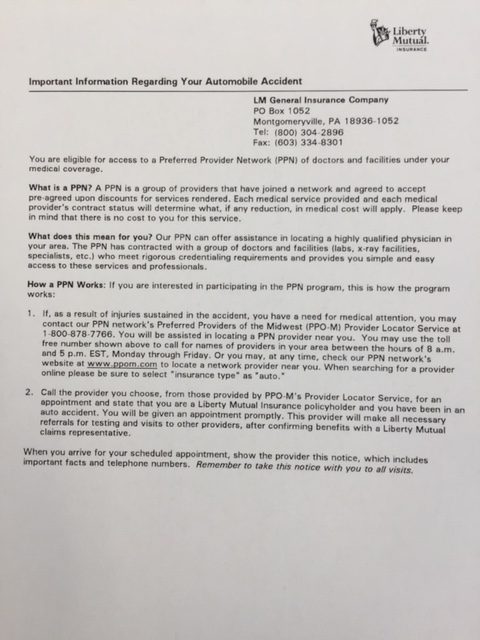

Liberty Mutual Insurance “Important Information” Insert

Liberty Mutual Insurance is one company that is trying to persuade injured persons to use its PPN. When providing persons with claim information, Liberty Mutual is now including a one-page insert titled “Important Information Regarding Your Automobile Accident.” (The picture on the left is a photocopy of the insert that Liberty Mutual is sending.)

This so-called “important information” tells injured persons that they can access a PPN of doctors and facilities through their medical coverage. It goes on to say:

“Our PPN can offer assistance in locating a highly qualified physician in your area. The PPN has contracted with a group of doctors and facilities … who meet rigorous credentialing requirements and provides you simple and easy access to these services and professionals.”

The insert then explains how the PPN program works and what injured persons should do, if they decide to use a doctor or facility through the PPN.

Attorney Tom Sinas is disturbed by what Liberty Mutual is doing, and wants auto-accident victims to be aware of their right to freely choose a medical provider.

Tom Sinas

“The insert doesn’t tell people that, under the No-Fault Act, they have the right to choose their providers,” Sinas says. “It makes it seem as though they have to go to some pre-approved list of doctors. It sets them up to have their care provided by insurance company doctors who have in mind the insurer’s bottom line, not the patient’s best interest.”

Attention Auto-Accident Victims: If you receive a letter like that from Liberty Mutual, do not be fooled. You have the right to choose your own medical provider — don’t let an insurance company lead you to believe otherwise.

Note: Persons injured in auto accidents need to know their rights and the benefits to which they are entitled. Click here to access a free copy of the Sinas Dramis Law Firm’s brochure, “The Michigan Auto No-Fault Law: Your Rights & Benefits.”